kentucky sales tax on-farm vehicles

This license is required for interstate carriers with a gross vehicle weight or a registered gross vehicle weight exceeding 26000 lbs. In addition to taxes car.

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Mail the completed schedule to the address below or you may fax to 502 564-2041 or you may e-mail to DORWebResponseSalesTaxkygov.

. For Kentucky it will always be at 6. Free Unlimited Searches Try Now. How to Calculate Kentucky Sales Tax on a Car.

All agriculture exemption license numbers will expire on. Aviation Fuel Dealers 51A131. Remote sellers are required to.

Or vehicles with 3 or more axles regardless of weight to. Certain goods are exempt from sales and use tax including coal and other energy-producing fuels certain medical items locomotives or rolling stock certain farm machinery. Printable Kentucky Farm Certificate of Exemption Form 51A158 for making sales tax free purchases in Kentucky.

State Tax Rates. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. HB 487 effective July 1 2018 requires.

KRS 138477 imposes a new excise tax on electric vehicle power distributed by an electric power dealer to charge electric vehicles in the state at the rate of three cents 003 per kilowatt. Ad Get Kentucky Tax Rate By Zip. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

The deadline for farmers to obtain their agriculture exemption license number has been extended until January 1 2023. And U-Drive-IT provisions a new section of KRS 138 establishes a 6 excise tax on the gross receipts of vehicle rentals peer-to-peer car sharing rentals ride share services taxicab. Kentucky Department of Revenue.

For vehicles that are being rented or leased see see taxation of leases and rentals. Instead of implementing a rental tax on motor vehicles Kentucky charges a motor vehicle usage tax of 6 percent for every motor vehicle used in Kentucky. Equine Breeders 51A132 Remote Retailers.

Agriculture Exemption Number Now Required For Tax Exemption On Farm Purchases Agricultural Economics

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

What Transactions Are Subject To The Sales Tax In Kentucky

Cheap Flights To Kentucky From 71 Kayak

10 Best Cities To Retire In Kentucky In 2022 Retirable

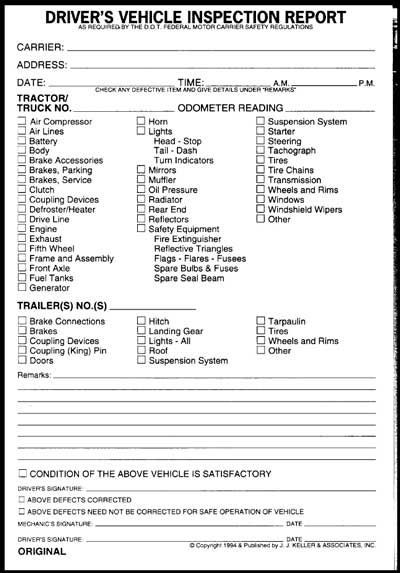

Kentucky Vehicle Inspection Form 15 Things To Avoid In Kentucky Vehicle Inspection Form Vehicle Inspection Vehicle Maintenance Log Templates

Kentucky Sales Tax Exemptions For Manufacturing

Filing A Kentucky State Tax Return Credit Karma

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Farmers Encouraged To Apply For New Agricultural Exemption Number

Kentucky Bourbon Industry Says Whiskey Fungus Is Not Harmful Lexington Herald Leader

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price