reit dividend tax rate

15 Withheld Foreign Tax Credit can be. The interest and dividends received by the ReitInvIT from.

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

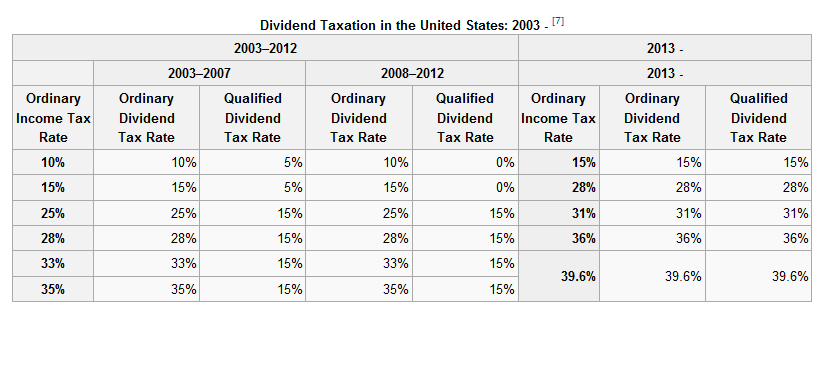

According to the IRS they are not qualified dividends even if they are shown in box 1b of Form 1099-DIV.

. Fundrise just delivered its 21st consecutive positive quarter. This level is still above the 20 maximum tax rate on qualified dividends paid by corporations but it is a. Target yield of 5.

ARR and ARR-PRC ARMOUR or the Company today confirmed the July 2022 cash dividend for the. Instead REIT dividends are considered capital gains distributions. CapitaLand Integrated Commercial Trust S50000000.

When you go to sell appreciated REIT shares however this growth will be subject to capital gains taxes. Residents may be subject to a 30 withholding tax on their REIT income. In a low risk portfolio.

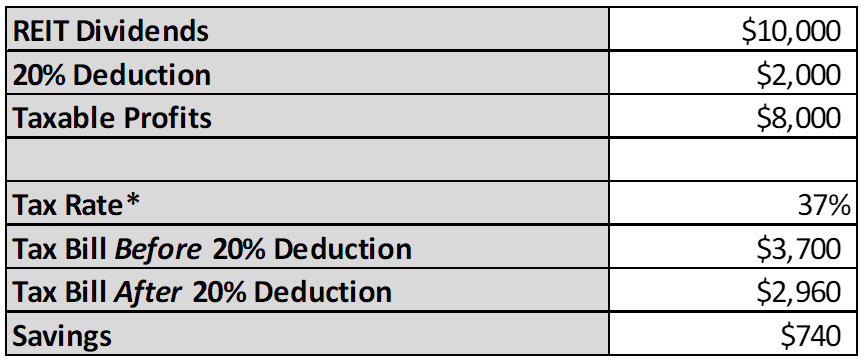

This provision qualified business income effectively lowers the federal tax rate on ordinary REIT dividends from 37. Among equity REITs the. ARMOUR Residential REIT Inc.

However this deduction will end in 2025. Ascendas REIT S50000000. Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income.

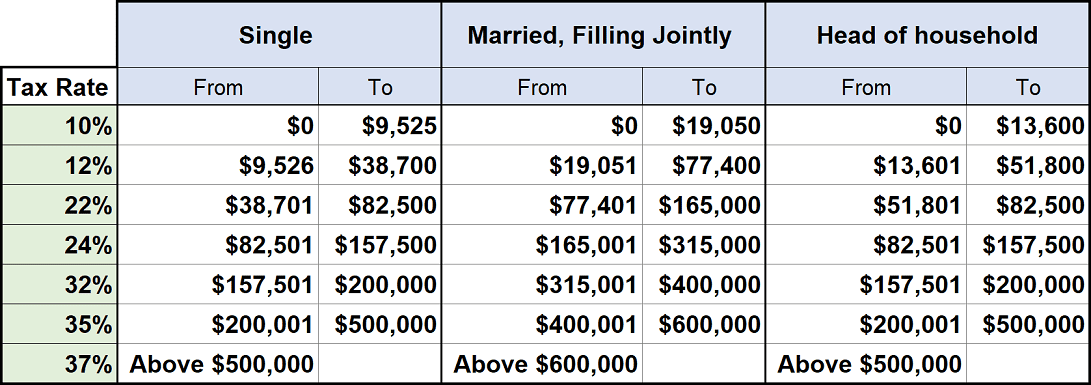

The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income. Long-term capital gains are. Corporation or a qualified foreign corporation and meet certain requirements under Sec.

As a result the company is exempt from paying income taxes on the profits paid. Ad Learn How Bank of America Private Bank Can Help You Explore Alternative Investment Options. Dividends from real estate investment trusts or REITs are considered taxable income in the eyes of the IRS but theres much more to.

65 tax rate if shareholder owns more than 50 of the REITs shares for the 12 months before the dividend is declared. As mentioned above Sec. This occurs when a REIT sells a property that it has owned for over a year and chose to distribute that income to shareholders.

VERO BEACH Florida July 01 2022 GLOBE NEWSWIRE ARMOUR Residential REIT Inc. Designed to last the next 10 years at least. That provides a slight reduction in tax rates while simultaneously amounting to an after-tax savings of.

5 rows No Taxes. 710 if shareholder owns at least 10 of the REITs voting stock except in the case of Jamaica and no more than 25 of the. Generally QDI tax rates apply if the dividends have been paid by a US.

Dividends paid in excess of current tax earnings. The income from your portfolio is simply a variable that you apply to your overall portfolio based on the investment you choose to hold. 7 rows Most REIT distributions are considered non-qualified dividends which means that they do not.

Confirms July 2022 Dividend Rate Per Common Share and Q3 2022 Monthly Dividend Rate Per Series C Preferred Share. The portion of a REIT dividend classified as income may be eligible for preferential tax treatment. For companies such tax may be the normal rate of 25 plus surcharge and cess or the concessional rate of 22 plus surcharge and cess.

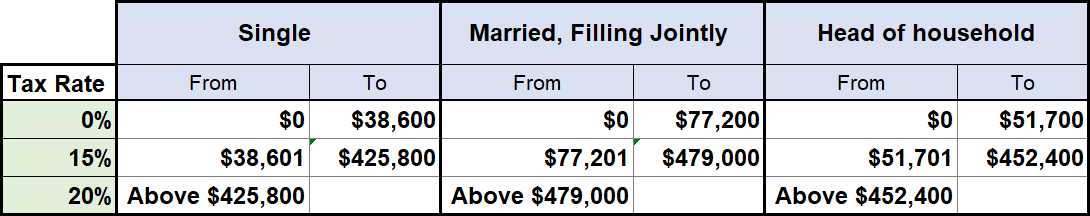

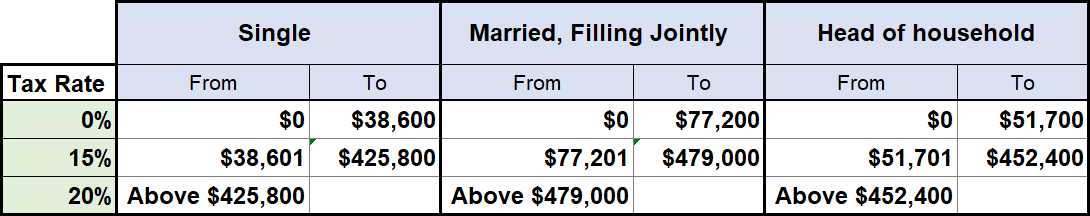

REIT dividends are not qualified dividends. In addition REITs must distribute 90 of their earnings to shareholders through dividends. If the property was owned for a year or more though it is considered a long-term gain and is taxed at either 0 15 or 20.

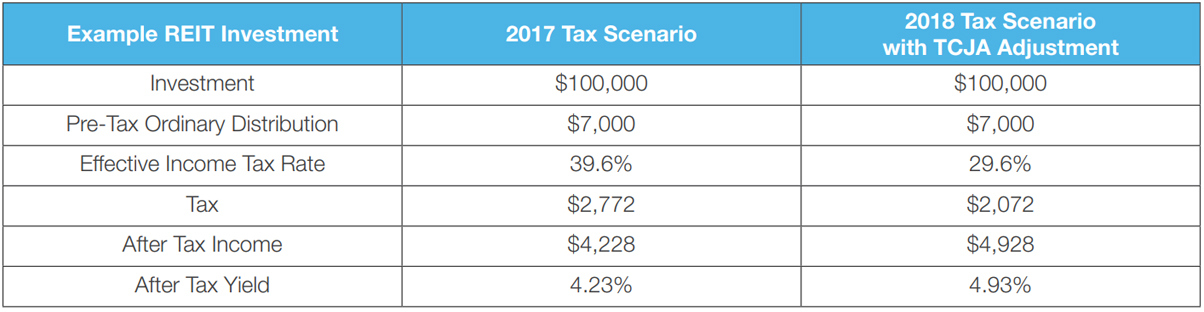

The Tax Cuts and Jobs Act TCJA provides a 20 deduction for pass-through business income including a qualified REIT dividend. Confirms July 2022 Dividend Rate Per Common Share and Q3 2022 Monthly Dividend Rate Per Series C Preferred Share. 2 days agoVERO BEACH Florida July 01 2022 GLOBE NEWSWIRE -- ARMOUR Residential REIT Inc.

ARMOUR Residential REIT Inc. These are taxed at the same rate as qualified dividends if you meet holding requirement of one year or more. The qualified REIT dividend is subject to the 45-day holding period rule at the shareholder level under Regs.

In general the 20 percent maximum capital gains tax rate plus the 38 percent Medicare Surtax applies to the sale of REIT stock. ARR and ARR-PRC ARMOUR or the Company today confirmed the July 2022 cash dividend for the Companys Common Stock and the Q3 2022 monthly cash dividend rate for the Companys Series C Preferred StockJuly 2022 Common Stock Dividend Information. According to the National Association of Real Estate Investment Trusts commonly referred to as Nareit the dividend yield across all REITs was nearly 4 in November 2019.

With minimal active investing. This might be how I would do it. There is no cap on the deduction no wage restriction and itemized deductions are not required to receive this benefit.

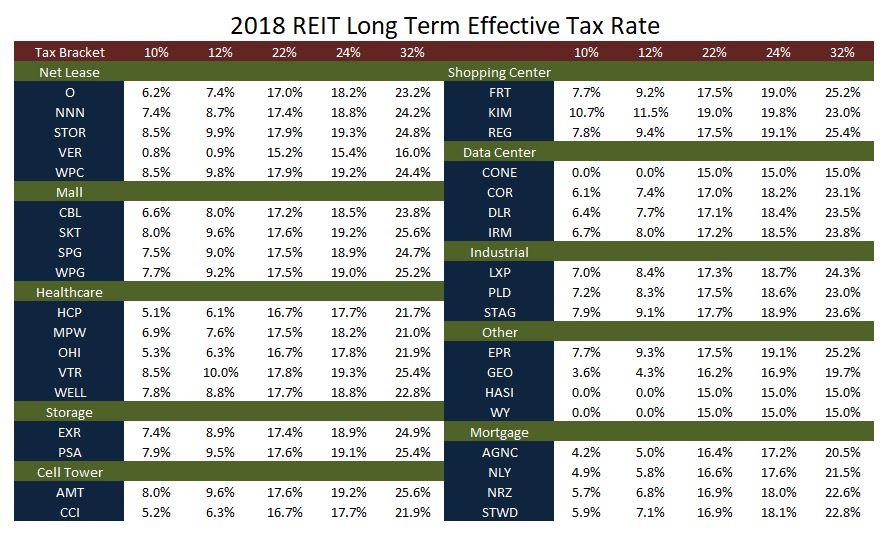

Retirement freedom is all about the size of your portfolio which is why its really critical that you know your rate of return. The government requires REITs to abide by several regulations including maintaining 75 of their assets and income in real estate and having a minimum of 100 shareholders. The tax law effectively lowered the federal tax rate on ordinary REIT dividends mortgage REITs included from 37 to 296 for a taxpayer in the highest bracket.

Individuals are now permitted to deduct up to 20 of ordinary REIT dividends. Second your REIT can also provide you with income in the form of share growth. Are REIT dividends subject to the maximum tax rate.

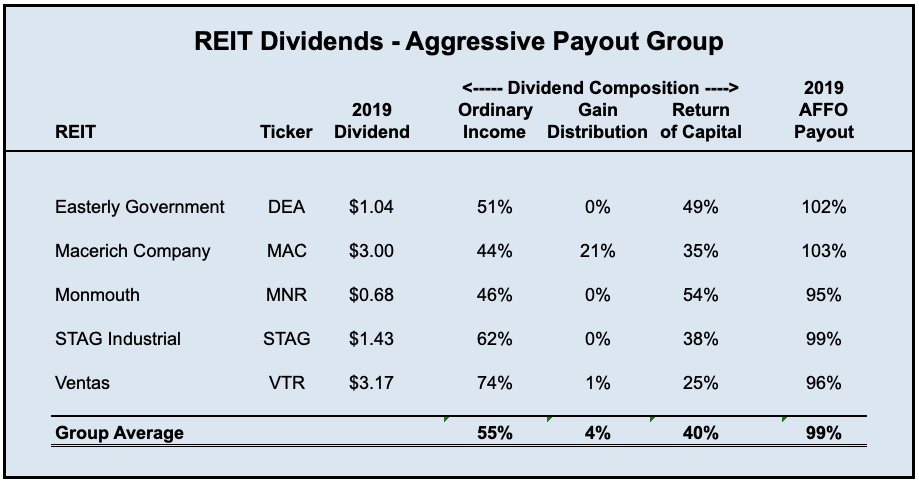

Because they can be allocated to ordinary income capital gains and return of capital REIT dividends can be taxed at various rates. How would I invest the 3 million in dividend stocks REITs.

Reit Tax Advantages Streitwise

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

Dividend Definitions How Are Dividends Taxed And At What Rates Dividendinvestor Com

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Guide To Reits Reit Tax Advantages More

Reits In India Features Pros Cons Tax Implications

How Tax Efficient Are Your Reits Seeking Alpha

Dividend Definitions How Are Dividends Taxed And At What Rates Dividendinvestor Com

U S Dividends And The Capital Gains Tax Rate Since 1961 Seeking Alpha

Reit Dividends Measuring What Matters Seeking Alpha

The Most Important Metrics For Reit Investing Intelligent Income By Simply Safe Dividends

Guide To Reits Reit Tax Advantages More

How To Pay No Tax On Your Dividend Income Retire By 40

Sec 199a And Subchapter M Rics Vs Reits

Reit Taxation A Canadian Guide

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends